FURLOUGH SCHEME LATEST CHANGES AND REMINDERS

Full details are available on HMRC website – we recommend that employers keep up to date with the latest rules and look at each iteration published.

There are lots of examples and calculators on HMRC website but the most common calculations are as follows:

Calculations for fixed monthly pay

Identify the period to use for calculation of ‘employees usual wage’

The Reference period is the last pay period ending on or before 19th March 2020 for employees who either:

- Were included in an RTI return on or before 19th March 2020

- You made a valid CJRS claim for in any period before 31st October 2020

For all other employees the reference period is the last pay day ending on or before 30th October 2020 – this only applies for furlough periods starting after 1st November 2020.

If your employee has worked enough overtime to have a ‘significant’ effect on the amount to pay you should calculate 80% of their usual wages using the ‘employees whose pay varies’ method.

Employees whose pay varies

For employees who were included in an RTI return on or before 19th March 2020 you should use the higher of:

- Wages earned in the corresponding calendar period in a previous year

- Average wages payable in the tax year 2019 to 2020

This also applies to anyone you made a valid CJRS claim for at any time before 31st October 2020.

For all other employees you should calculate 80% of the average wages payable between 6th April 2020 (or their start date if later) and the day before they were first furloughed on or after 1st November 2020.

Calendar lookback method

When looking at the corresponding period in a previous year the following months should be used:

Claim Month Lookback Period

February 2021 February 2020

March 2021 March 2019

April 2021 April 2019

If your employee did not work for you in the lookback period, you can only use the averaging method (see below) to calculate 80% of their wages.

To calculate 80% of the wages from the corresponding calendar period in a previous year:

- Start with the amount earned in the lookback period

- Divide by total calendar days in that pay period

- Multiply by number of furlough days in the pay period being claimed for

- Multiply by 80%

February 2021 – If you are claiming for an employee who is furloughed for the whole of February 2021 you can either use the full month or 28/29ths to reflect that 2020 was a leap year.

Averaging Method

To work out the average monthly wages for 2019/20

- Start with amount of wages paid in the tax year up to the day before they were first furloughed

- Divide by the number of calendar days from the start of the tax year (or their start date) up to the day before they were first furloughed

- Multiply by the number of furlough days in the pay period you are claiming for

- Multiply by 80%

Furlough Days

Furlough days in the above calculations are the number of days employees are on furlough within a claim period, it will not necessarily be the whole period

You may have employees on ‘flexible’ furlough for the whole period in which case the ‘furlough days’ are the whole period and normal hours for the whole period will be reported against hours worked in the same period.

Maximum amounts

To work out the maximum you can claim, multiply the daily maximum by the number of calendar days the employee is furloughed in your claim (£2,500 monthly maximum).

February 2021 Maximum £89.29 per day

March 2021 Maximum £80.65 per day

April 2021 Maximum £83.34 per day

Statutory Sick Pay Rebate

You can claim back SSP that you have paid to employees who are off sick, self-isolating or shielding because of coronavirus.

You should pay SSP from day 1 (no need to apply normal 3 waiting days) and you can recover up to 2 weeks of SSP paid if:

- You have already paid your employee’s SSP

- You’re claiming for an employee who’s eligible for sick pay due to coronavirus

- You have a PAYE scheme that was started before the 28th February 2020

- You had fewer than 250 employees across all your PAYE schemes on 28th February 2020

Employees do not have to give you a doctor’s fit note for you to make the claim but you can ask them to give you either:

- An isolation note from NHS 111 if they are self-isolating

- A ‘shielding note’ from their doctor or health authority

You can claim for the same employee from CJRS and SSP Rebate scheme but not for the same period of time.

RATES AND LIMITS FROM APRIL 2021

TAX – England & NI – Subject to confirmation in budget

Basic Personal Allowance £12,570

Income Limit for Personal Allowance £100,000

Emergency Tax Code 1257L

20% Basic Rate £0 – £37,700

40% Higher Rate £37,701 – £150,000

45% Additional Rate Over £150,000

TAX – Scotland Only – subject to parliamentary approval

Basic Personal Allowance £12,570

Income Limit for Personal Allowance £100,000

Emergency Tax Code 1257L

19% Starter Rate £0 – £2,097

20% Basic Rate £2,098 – £12,726

21% Intermediate Rate £12,727 – £31,092

41% Higher Rate £31,093 – £150,000

46% Top Rate Over £150,000

TAX – Wales – Subject to parliamentary approval

Basic Personal Allowance £12,570

Income Limit for Personal Allowance £100,000

Emergency Tax Code 1257L

20% Basic Rate £0 – £37,700

40% Higher Rate £37,701 – £150,000

45% Additional Rate Over £150,000

NATIONAL INSURANCE

Lower Earnings Limit £120 per week

Primary Threshold (Employee) £184 per week

Secondary Threshold (Employer) £170 per week

Upper Earnings Limit £967 per week

Percentage Rates remain unchanged at 13.8% Employer and 12% Employee to UEL then 2%.

EMPLOYERS NI FOR UNDER 21s and apprentices

Employers National Insurance contributions are not payable for all employees under the age of 21 or for apprentices under the age of 25 whose earnings are under the Upper Secondary Threshold (£967 per week). Earnings above this will attract Employers NI at the normal secondary rate of 13.8%.

TERMINTAION AWARDS AND SPORTING TESTIMONIALS

Class 1A Employers National Insurance is payable on Termination Awards paid to employees that exceed £30,000.

Class 1A Employers National Insurance is payable on the amount of Sporting Testimonial payments paid by committees which exceed £100,000.

These are reported and paid as part of the normal payroll process during the tax year.

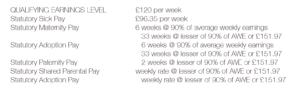

STATUTORY PAYMENTS

RECOVERY FROM HMRC

SSP is a company cost and cannot be recovered from HMRC (except in certain circumstances for Covid 19)

SMP/SAP/SPP/ShPP – you can recover 92% of all statutory payments made. If you are a small employer with a total NI bill of less than £45,000 you can claim 103% recovery.

STUDENT LOANS

Earnings thresholds from April 2020:

Plan 1 – £19,895

Plan 2 – £27,295

Plan 4 – £25,000 – deductions for Plan 1, Plan 2 and Plan 4 are 9%

Postgraduate Loans – earnings threshold £21,000, deductions 6%

NATIONAL MINIMUM AND NATIONAL LIVING WAGE

The new National Living Wage and Minimum Wage Rates apply from 1st April 2021;

Minimum Living Wage Rate for over 23s – £8.91 per hour (from £8.72 over 25)

Adult Rate (21 – 22 year olds) £8.36 per hour (from £8.20)

18 -20 year olds £6.56 per hour (from £6.45)

16-17 year olds £4.62 per hour (from £4.55)

Apprentice Rate £4.30 per hour (from £4.15)

AUTO ENROLMENT

- Trigger remains at £10,000

- Lower limit for Qualifying Earnings stays at £6,240

- Upper limit for Qualifying Earnings increases to £50,270

PAYROLLING BENEFITS

If you are going to payroll benefits to avoid the P11D process from April 2021 you must register with HMRC before the end of the current tax year.

https://www.gov.uk/guidance/paying-your-employees-expenses-and-benefits-through-your-payroll

HMRC will then strip out any benefits from employee tax codes for the new tax year. Benefits can then be taxed through the payroll ensuring that tax is paid in real time and making it more transparent for employees.

EMPLOYMENT ALLOWANCE (EA)

From April 2021 you can claim up to £4,000 Employer’s NI relief provided your Class 1 National Insurance liability was less than £100,000 in the previous tax year.

This change means that EA will be operated as ‘de minimis State aid’.

We will automatically stop your EA claim in the new tax year if we can see that your previous NI liability exceeded £100,000 but you will need to let us know if any of the following apply

- You are part of a group and EA is being claimed elsewhere in the group

- You claim the EA on behalf of a group and the total group NI bill exceeded £100,000 last tax year

- You have other de minimis State aid

OFF PAYROLL WORKING

- The new rules from April 2021 transfer the responsibility for operating the off payroll rules from the individual’s Personal Service Company (PSC), to the organisation or business that they are supplying the service to.

- The rules will apply to medium and large employers who engage the services of contractors through agencies and intermediaries.

Small employers are outside the scope of the new regulations. This is defined in the normal way of having at least 2 of the following 3 points.

- Annual Turnover less than £10.2 million

- Balance sheet of less than £5.1 million

- Not more than 50 employees

If a small employer is part of a group the whole group would need to satisfy the above to be exempt.

If a small employer becomes medium sized they would have to apply the rules in the year after the accounts submission in which they were over the limits.

- Enhancements have been made to the ‘Check Employment Status for Tax’ (CEST) service and guidance and the CEST tool is available on HMRC website.

- The fee payer/intermediary must provide the status determination to the next person in the supply chain so that the contractor is informed.

- The fee payer is treated as an employer for the purposes of Income Tax and National Insurance but does not need to apply student loans, court orders, apprentice levy or pensions auto enrolment. The contractor should complete the normal HMRC starter declaration but it would be expected that their PSC is their main employer so they would tick box C.

- The rules only apply if the contractor works through their own PSC or intermediary. If you have contractors that are self employed you still need to apply the normal employment status checks to ensure they shouldn’t be treated as an employee.

ULTRA LOW EMISSION AND DIESEL COMPANY CARS

From 6th April 2020 there will be a new zero emission mileage field shown on the P46 (car). If a hybrid car has a CO2 emission figure of 1-50g/kg you will need to provide the car’s zero emission mileage. This is the maximum distance in miles that the car can be driven in electric mode without recharging the battery.

To report diesel cars and fuel on 2020/21 P11Ds you will need to enter the correct key letter in ‘type of fuel or power used’

- Cars that meet the Euro 6D standard will use fuel letter F

- Cars that don’t meet the standard will use fuel letter D

Letter F cars will not have the diesel supplement added when calculating the cash equivalent for tax.

BACS REPORTS

As a BACS bureau we pay many clients payrolls directly through the BACS system which is a safe, secure and time efficient way of making payments. As agents though, we do not have access to the exception reports that may be generated as a result of us sending a payroll file. These reports (normally AWACS or ARACS reports) need to be regularly reviewed within your organisation on a regular basis and passed to us for action.